Invest in Air Conditioning with RevoluSun

keeping your home cool is essential

Qualify for this Tax credit

30% Federal Tax Credit for AC

One of the most compelling reasons to invest in a new AC system now is the federal Residential Energy Efficient Property Credit, which offers homeowners a 30% tax credit on the cost of installing a qualifying mini-split air conditioning system. This credit covers 30% of the total cost, including both the equipment and installation expenses, significantly reducing your overall investment. To qualify for this tax credit, your AC system must meet specific energy efficiency criteria. RevoluSun’s mini-split systems are designed to exceed these standards, ensuring you maximize your savings. By filing IRS Form 5695 with your federal tax return and keeping all relevant receipts, you can easily claim this credit and enjoy substantial financial relief.

40 years of combined experience

Comfort and Savings

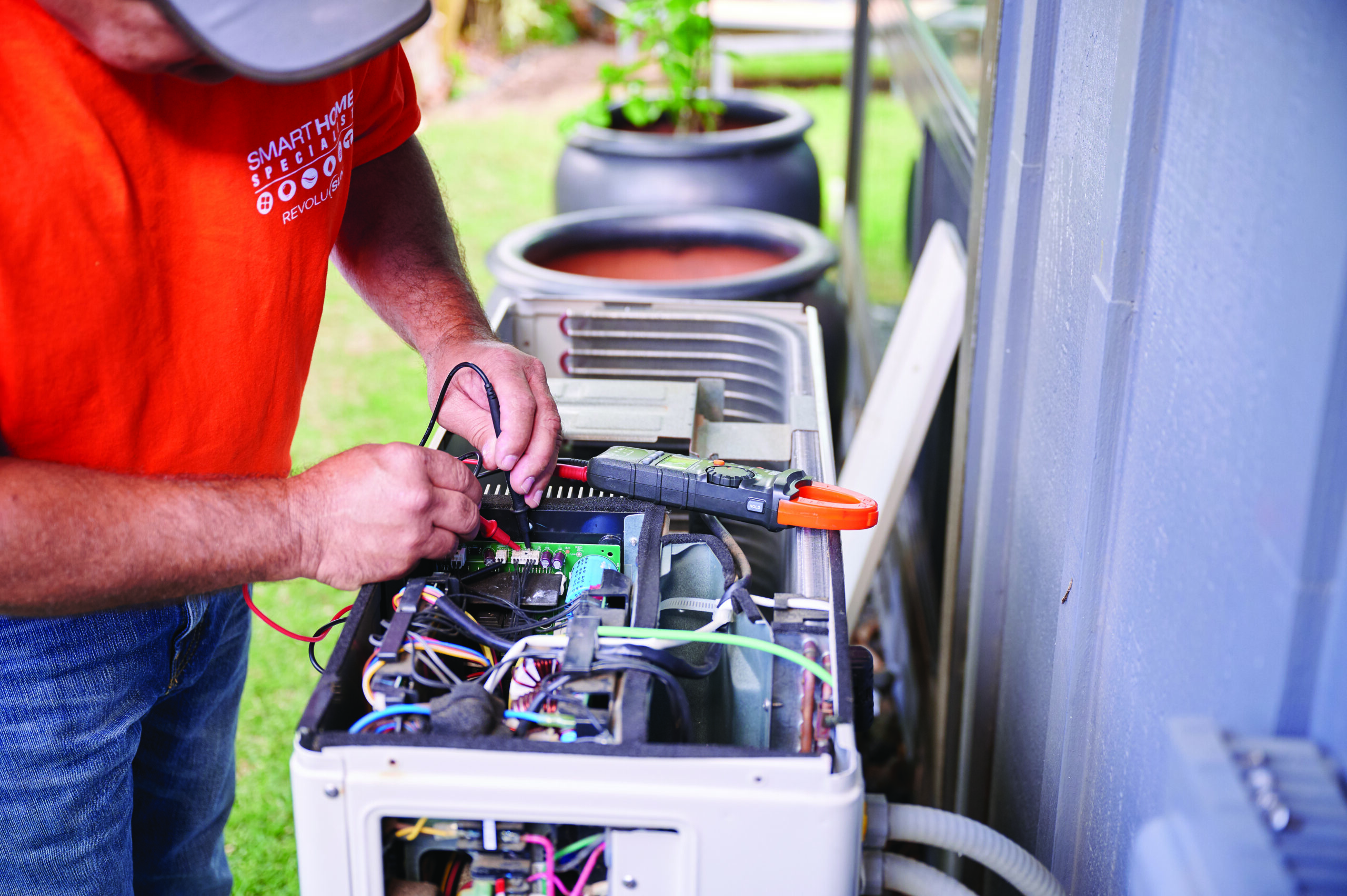

RevoluSun, known for its expertise in solar energy, has brought the same level of innovation to the HVAC industry. Their team, with over 40 years of combined experience, specializes in custom-designed air conditioning systems tailored to Hawaii’s unique climate. This ensures that every system is optimized for both performance and efficiency. What sets RevoluSun apart is their comprehensive approach, from consultation to installation and ongoing maintenance. Their 12-year workmanship warranty on all installations reflects their confidence in their work and commitment to customer satisfaction. To qualify for this tax credit, your AC system must meet specific energy efficiency criteria. RevoluSun’s mini-split systems are designed to exceed these standards, ensuring you maximize your savings. By filing IRS Form 5695 with your federal tax return and keeping all relevant receipts, you can easily claim this credit and enjoy substantial financial relief.

invest in a new AC system

The Perfect Time to Upgrade

As temperatures continue to rise, the need for a reliable cooling system becomes more pressing. With RevoluSun’s expertise and the significant financial benefits currently available, there’s never been a better time to invest in a new AC system. Take advantage of the 30% federal tax credit, reduce your energy bills, and keep your home cool all year long. Contact RevoluSun today to learn more about how you can stay comfortable and save money with a state-of-the-art AC system. Visit revolusun.com or call 808.748.8888 to schedule your consultation. What sets RevoluSun apart is their comprehensive approach, from consultation to installation and ongoing maintenance. Their 12-year workmanship warranty on all installations reflects their confidence in their work and commitment to customer satisfaction. To qualify for this tax credit, your AC system must meet specific energy efficiency criteria. RevoluSun’s mini-split systems are designed to exceed these standards, ensuring you maximize your savings. By filing IRS Form 5695 with your federal tax return and keeping all relevant receipts, you can easily claim this credit and enjoy substantial financial relief.